Asian stocks slip after US tech selloff, Investors eye Powell speech

Asian equity markets were mostly lower on Wednesday, tracking heavy losses in U.S. technology shares and as traders look ahead to signals on interest rate policy from the Federal Reserve.

The downturn followed a sharp drop in Wall Street’s biggest tech names on Tuesday, with Nvidia, Palantir, and Oracle among those seeing steep declines. The selloff added to concerns that this year’s rapid rally in tech stocks may be outpacing economic fundamentals.

Tokyo’s Nikkei led regional losses in early trading, while markets in Hong Kong, South Korea, Taipei, and Bangkok also slipped. In contrast, equities in Shanghai, Sydney, and Manila managed to edge higher.

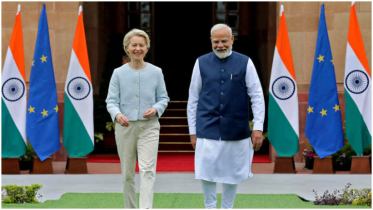

Adding to investor caution, recent geopolitical developments have stirred volatility. Top U.S. and European military officials met in Washington on Tuesday to discuss the framework for a possible peace deal in Ukraine, following President Donald Trump’s high-profile talks with Russian President Vladimir Putin in Alaska. Ukrainian President Volodymyr Zelensky has also expressed readiness to meet Putin directly. The diplomatic push has kept oil prices choppy, with crude retreating on Tuesday after earlier gains.

Economic data also weighed on sentiment, with Japan reporting its sharpest export decline in more than four years last month. Meanwhile, trade tensions remain in focus as Trump’s tariff measures continue to pressure global commerce.

Investors are now awaiting Fed Chair Jerome Powell’s remarks at the annual Jackson Hole gathering of central bankers on Friday. Markets widely expect a rate cut at the Fed’s September meeting, though recent U.S. inflation readings have been mixed.

“Powell’s Wyoming speech is shaping up as a balancing act,” noted Stephen Innes of SPI Asset Management. “A dovish tone risks igniting long-term inflation concerns, while a tougher stance could suffocate equities that are already trading at lofty levels.”

Key figures at around 0215 GMT

Tokyo - Nikkei 225: DOWN 1.6 percent at 42835.84

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 25045.13

Shanghai - Composite: UP 0.1 percent at 3,731.51

Euro/dollar: DOWN at $1.1625 from $1.1646 on Tuesday

Pound/dollar: DOWN at $1.3465 from $1.3489

Dollar/yen: DOWN at 147.60 yen from 147.64 yen

Euro/pound: UP at 86.34 pence from 86.33 pence

West Texas Intermediate: UP 0.6 percent at $62.72 per barrel

Brent North Sea Crude: UP 0.1 percent at $65.86 per barrel

New York - Dow: FLAT at 44,922.27 (close)

London - FTSE 100: UP 0.3 percent at 9,189.22 (close)

.png)