Asia stocks mixed as oil tumbles after Trump tones down Iran stance

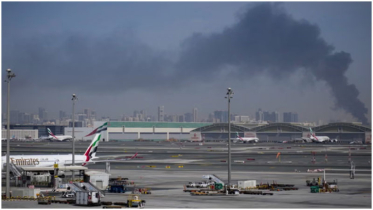

Oil and precious metals pulled back Thursday after US President Donald Trump suggested he was in no rush to intervene militarily in Iran, easing fears of disruption to global energy supplies.

Crude prices, which had spiked in recent days on expectations of possible US action, slipped about three percent after Trump said he would “watch it and see” following reports the crackdown on Iranian protesters had eased. Gold and silver also fell.

Asian equities offered a patchy picture. Hong Kong, Shanghai, Taipei, Wellington, Mumbai and Kuala Lumpur declined, while Sydney, Seoul, Bangkok and Manila inched higher. Tokyo dipped as investors paused after recent election-driven gains.

The moves came after another slightly weaker session on Wall Street, where solid bank earnings and upbeat US retail sales failed to shake investor unease over geopolitical risks and Trump’s unpredictable economic policy signals — including threats to Federal Reserve independence and a proposed cap on credit card interest rates.

Amid currency jitters, the South Korean won briefly rebounded after US Treasury Secretary Scott Bessent said its steep slide was “not in line” with the country’s fundamentals, though analysts warned broader market sentiment may determine the path ahead.

In Japan, Prime Minister Sanae Takaichi’s government signaled plans to dissolve parliament for a snap vote, as her administration seeks approval for a record national budget aimed at tackling inflation and bolstering economic growth.

Oil prices pulled back sharply, with West Texas Intermediate around $60 and Brent near $64.60 per barrel in early morning trade.

.png)