India scales back Russian oil buying as US trade deal talks advance

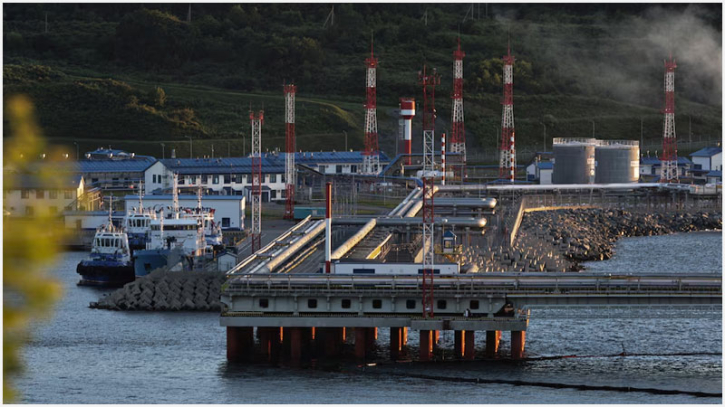

Indian refiners are stepping back from purchasing Russian oil for upcoming deliveries, a move seen as supporting New Delhi’s efforts to finalize a trade agreement with the United States.

Industry sources say several major refiners, including Indian Oil, Bharat Petroleum and Reliance Industries, are declining new offers for Russian crude scheduled to load in March and April, although some previously arranged March shipments will still arrive.

The shift comes as Washington and New Delhi work toward a trade framework they aim to complete by March, focusing on lower tariffs and stronger economic cooperation. While the joint statement on the talks did not mention Russian oil directly, U.S. President Donald Trump said India had committed to halting purchases, leading to the removal of earlier tariffs on Indian goods. Indian officials have not formally announced any plan to stop imports but say diversifying energy sources remains a key strategy.

India became a major buyer of discounted Russian crude after the 2022 invasion of Ukraine triggered Western sanctions on Moscow’s energy sector. Recently, however, most Indian refiners have reduced or paused purchases, increasing imports from the Middle East, Africa and South America instead.

One exception could be Nayara Energy, a Russia-backed private refiner that relies mainly on Russian oil, though its imports are expected to pause temporarily due to a scheduled refinery maintenance shutdown. Sources also say refiners may resume Russian purchases if directed by the government.

India’s Russian oil imports have already fallen sharply, dropping to their lowest level in two years in December. Volumes are expected to decrease further in the coming months, potentially falling to 500,000–600,000 barrels per day from an average of 1.7 million barrels per day last year, reflecting both market pressures and shifting geopolitical dynamics.

.png)