Asian stocks dip as investors await Trump-Xi meeting on trade deal

Asian markets opened slightly lower Tuesday as investors turned cautious ahead of Donald Trump’s visit to Japan and his upcoming meeting with Chinese President Xi Jinping later this week.

Trump is scheduled to meet Xi on Thursday in South Korea, and optimism about a potential trade agreement between the world’s two largest economies has fueled recent gains in global markets. On Wall Street, stocks hit record highs Monday, supported by hopes of easing trade tensions and anticipation of quarterly earnings from major tech firms including Microsoft and Meta.

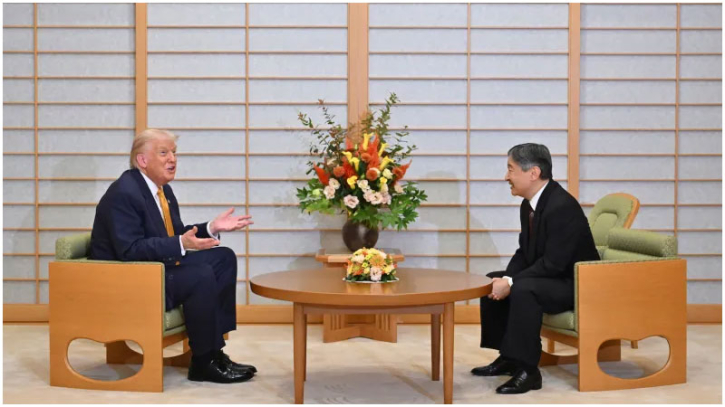

In Tokyo, Trump met Japan’s new Prime Minister Sanae Takaichi, reaffirming that the United States remains “an ally at the strongest level.” The White House said both nations had signed a new deal on the supply of rare earth minerals, a key sector largely dominated by China.

Japan’s Nikkei 225 index, which crossed the 50,000 mark for the first time on Monday, trimmed some of its earlier gains. Markets in Hong Kong and Sydney also edged lower, while Seoul’s benchmark index dropped more than one percent. Taipei shares saw modest gains, and Shanghai remained little changed.

Chris Weston of Pepperstone noted that the strong performance at the start of the week was “driven by news that the United States and China were set to forge some sort of trade agreement,” adding that limited U.S. economic data amid the ongoing government shutdown has reduced broader risks for investors.

Despite persistent tensions between Washington and Beijing, optimism has returned as Trump signaled a softer stance on tariffs. Speaking before arriving in Japan, he said he was “hopeful of a deal” with Xi, whom he will meet on the sidelines of the Asia-Pacific Economic Cooperation summit — their first in-person meeting since Trump’s return to office.

China’s chief trade negotiator Li Chenggang confirmed Sunday that the two sides had reached a “preliminary consensus” on key trade issues, setting the stage for further progress later this week.

.png)