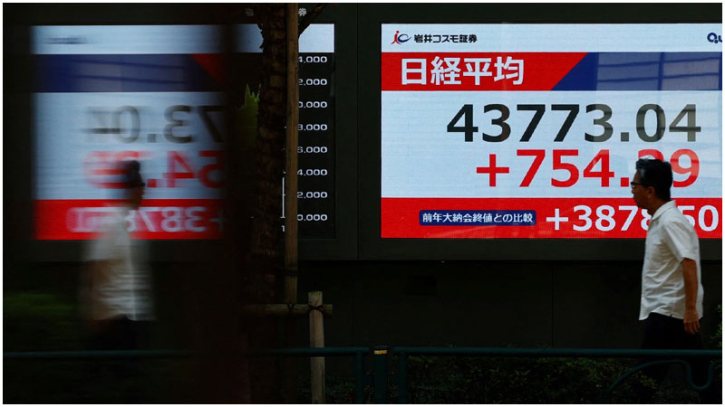

Asian stocks mixed ahead of key US data releases

Asian equities traded cautiously on Thursday as investors awaited upcoming US inflation and jobs figures, seen as pivotal for the Federal Reserve’s interest rate outlook.

Markets have rallied strongly in recent months, rebounding from the slump sparked by Donald Trump’s April tariff announcement, amid optimism over new trade deals and expectations of Fed rate cuts. The central bank delivered a reduction last week and signaled the possibility of two more cuts this year, citing subdued inflation and a soft labor market.

Still, Fed Chair Jerome Powell has urged caution, warning that equities look “fairly highly valued” and that policymakers face “no risk-free path” on rates. His remarks helped temper recent bullish sentiment. Investors are now focused on Friday’s PCE index, the Fed’s preferred inflation measure, and next week’s U.S. non-farm payrolls report.

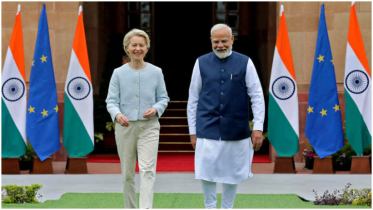

On Thursday, Tokyo stocks advanced firmly, while Hong Kong was flat despite continued strength in Alibaba, which gained over 1% after a 9% surge the previous day on news of a $53 billion AI investment plan. Chery Automobile soared more than 13% on its Hong Kong trading debut following a $1.2 billion IPO. Shanghai, Sydney, and Singapore posted small losses, while Taipei, Seoul, and Manila were little changed.

The mixed session followed a second consecutive decline on Wall Street across all major indices.

Despite recent volatility, Bank of America analysts remained optimistic, arguing that easier fiscal conditions globally and U.S. rate cuts amid broadening corporate profits could fuel strong earnings and GDP growth. “Sticky inflation could support sales and operating leverage, raising the odds of a 2026 boom over stagflation or recession,” the bank noted.

.png)