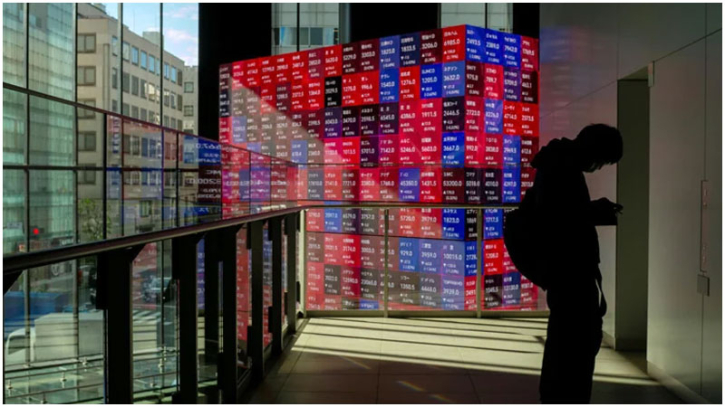

Asian stocks fall as Wall Street slump and AI worries hit sentiment

Asian stock markets retreated on Thursday, tracking losses on Wall Street as growing concerns over heavy spending in the artificial intelligence sector weighed on investor confidence.

Hopes for a year-end rally have faded after the US Federal Reserve signalled last week that it may pause interest rate cuts next month, while questions continue to mount over whether massive investment in AI will deliver expected returns.

Although three consecutive rate cuts by the Fed had supported equities in recent months, investors now fear that policy support could ease. Attention is also on key US inflation data due later in the day, which may offer clues about future monetary policy after a recent jobs report provided limited guidance.

Focus has returned to the technology sector amid speculation that valuations may be overstretched. Software and chipmakers have driven markets to record highs this year, but doubts are growing over when AI investments will begin to pay off.

Those concerns intensified after reports that private equity firm Blue Owl withdrew from Oracle’s $10 billion data centre project, casting uncertainty over the plan. The news followed disappointing earnings from Oracle and chipmaker Broadcom last week.

Oracle shares fell more than five percent on Wednesday, while Broadcom and other major tech stocks including Nvidia, Alphabet and Advanced Micro Devices also declined. The Nasdaq dropped 1.8 percent, and the S&P 500 lost more than one percent.

CMC Markets analyst Michael Hewson said rising valuations had fuelled fears of an AI bubble, noting increased market volatility due to end-of-year profit-taking. He added that some investors expect a shakeout in the sector by 2026.

Asian markets mirrored the US downturn, led by losses in technology stocks such as Japan’s Renesas and investment firm SoftBank. Tokyo and Seoul fell more than one percent, while Hong Kong, Sydney, Singapore, Wellington, Taipei, Manila and Jakarta also declined. Shanghai was flat.

Oil prices rose for a second day, gaining more than one percent after Washington said US forces struck a vessel linked to drug trafficking in the Pacific, heightening concerns over US policy toward Venezuela following President Donald Trump’s order to block sanctioned oil tankers.

.png)