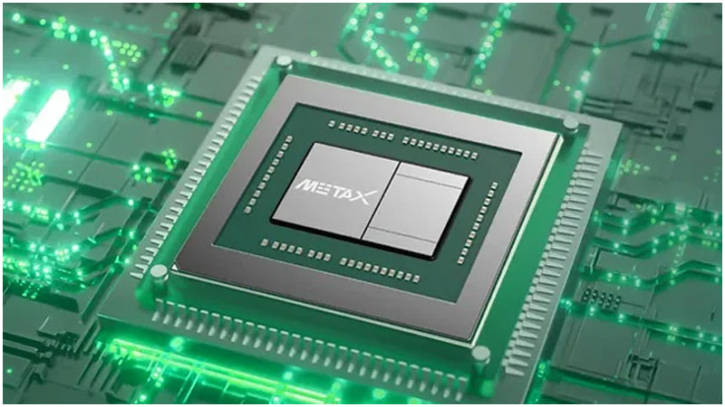

China's MetaX surges over 750% on Shanghai debut amid AI chip optimism

Shares of China’s MetaX Integrated Circuits surged dramatically on their first day of trading in Shanghai on Wednesday, jumping more than 750 percent as investors bet on the country’s growing ambition to build a strong domestic chip industry capable of challenging US leader Nvidia.

The strong debut came less than two weeks after another Chinese chipmaker, Moore Threads, saw its shares soar 425 percent following a $1.1 billion initial public offering. Both companies produce graphics processing units, or GPUs, which are critical for running and training artificial intelligence systems.

Global demand for AI hardware has turned GPUs into one of the most sought-after technologies, a market currently dominated by Nvidia, now the world’s most valuable company. While MetaX and Moore Threads remain far smaller players, investor enthusiasm reflects expectations that China will significantly scale up its semiconductor capabilities.

MetaX shares were priced at 104.66 yuan in an IPO that raised about $586 million. During Wednesday’s session, the stock climbed as high as 895 yuan before easing back to around 730 yuan by the close.

The surge comes amid intensifying competition between China and the United States for leadership in artificial intelligence. Beijing has encouraged domestic tech firms to adopt locally produced chips as Washington maintains export restrictions on Nvidia’s most advanced products.

Last week, however, US President Donald Trump said he had agreed with Chinese President Xi Jinping to allow Nvidia to export its H200 chips to China. While those processors lag Nvidia’s most advanced models by roughly 18 months and remain less powerful than the latest US-only offerings, the decision signalled a partial shift away from the strict controls imposed under former president Joe Biden.

Those curbs, first introduced in 2022, were justified on national security grounds, including concerns that advanced chips could enhance China’s military capabilities.

According to Rui Ma, founder of the Tech Buzz China newsletter, US export controls have effectively created a protected high-end market segment for Chinese chipmakers. With strong policy backing and access to deeper pools of capital, she said domestic GPU and AI accelerator firms now enjoy far more favourable conditions than in previous cycles, helping drive strong investor interest in companies such as MetaX, Moore Threads, Cambricon, Biren and Enflame.

.png)