Fed cuts interest rates again, but future moves remain unclear

The US Federal Reserve has lowered interest rates for the third time this year, but disagreements among policymakers have created uncertainty over whether more cuts are coming.

On Wednesday, the Fed reduced its benchmark lending rate by 0.25 percentage points to a range of 3.50%–3.75%, the lowest level in three years. Officials, however, remain split on how to balance a slowing job market with inflation still above target.

New economic projections suggest only one more rate cut is expected next year, though this could change as fresh data arrives. Fed chair Jerome Powell said the central bank will take its time to study the impact of this year’s three cuts before making further decisions.

“We are well-positioned to wait and see how the economy evolves,” Powell said.

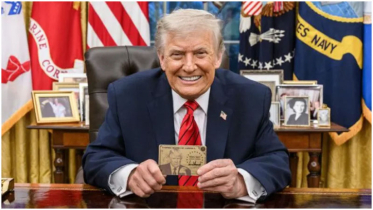

The decision was not unanimous. Three officials dissented: one favored a larger cut, while two wanted rates to stay unchanged. President Donald Trump criticized the move as too small, saying rates should be much lower.

A shortage of recent government data—caused by the long US government shutdown—has left policymakers with limited visibility. Still, the Fed appears more concerned with a cooling labor market than with inflation. The unemployment rate rose from 4.3% to 4.4% in September, while inflation reached 3%, above the Fed’s 2% goal.

Internal disagreements continue over whether the Fed should prioritize reducing inflation or supporting jobs. Powell said such tension between the Fed’s dual mandates is uncommon but manageable.

The Fed’s latest “dot plot” forecast shows a median expectation for one additional 0.25 percentage-point cut in 2026, unchanged from earlier projections.

More clarity is expected next week with new data on labor markets and inflation, which could influence calls for additional easing if the job market weakens further.

Meanwhile, uncertainty is growing over who will replace Powell when his term ends next May. President Trump is expected to announce a nominee soon, with economic adviser Kevin Hassett seen as the leading candidate. Analysts warn that whoever is chosen must demonstrate independence to avoid unsettling financial markets.

Powell said the search for his successor has no impact on his work or decision-making.

.png)