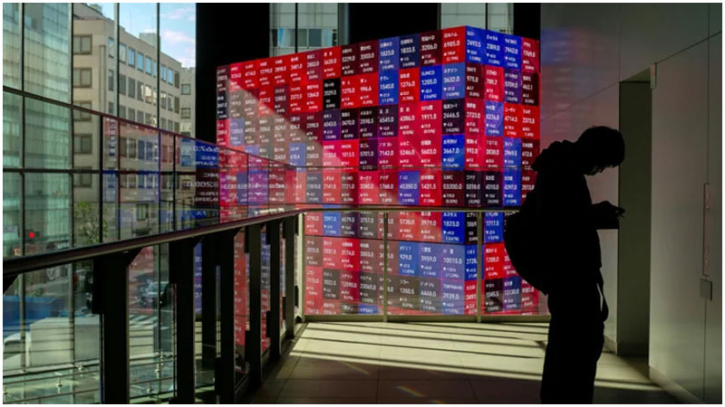

Asian stocks slide on renewed tech concerns

Asian stock markets fell on Monday, tracking losses on Wall Street as renewed concerns about the tech sector weighed on investor sentiment.

The decline followed weak earnings last week from major technology firms, which revived doubts about whether heavy investment in artificial intelligence will deliver returns quickly enough. The pullback came after investors shifted focus away from US monetary policy following the Federal Reserve’s third consecutive interest rate cut.

Technology stocks, which have driven global equity gains for the past two years, have struggled recently amid worries that valuations have risen too far. Disappointing results from Oracle and Broadcom added to those concerns.

Wall Street closed sharply lower on Friday, with the S&P 500 and Nasdaq each falling more than one percent. Asian markets followed suit, led by losses in Tokyo and Seoul. Shares also declined in Sydney, Singapore, Wellington and Taipei, while Shanghai ended flat despite fresh weak Chinese consumer data.

South Korean chipmakers Samsung Electronics and SK hynix were among the biggest decliners. In Japan, SoftBank Group fell more than seven percent.

Investors are also preparing for a busy week of US economic data, including delayed jobs reports for October and November and new inflation figures. The data could influence expectations for the Federal Reserve’s next interest rate decision in January, as traders scale back forecasts for further rate cuts next year.

Attention is also focused on leadership at the Fed, with Jerome Powell due to step down in May. US President Donald Trump said the next chair should consult with him and reiterated his view that interest rates should fall to around one percent or lower.

In Japan, markets are looking ahead to the Bank of Japan’s policy decision on Friday, with some expectations of a rate hike. Analysts say a weaker yen, now above 150 to the dollar, is a key factor behind the central bank’s considerations.

By mid-morning in Asia, Tokyo’s Nikkei 225 was down 1.5 percent, Hong Kong’s Hang Seng fell 0.7 percent, and oil prices edged higher. The dollar was little changed against major currencies.

.png)