IMF raises global growth forecast as trade tensions ease slightly

The International Monetary Fund (IMF) has raised its global economic growth forecast, citing a temporary softening of some U.S. tariffs and increased government efforts to stimulate growth. The revised projections now expect global growth to reach 3% in 2025 and 3.1% in 2026, up from 2.8% and 3%, respectively, in April's report.

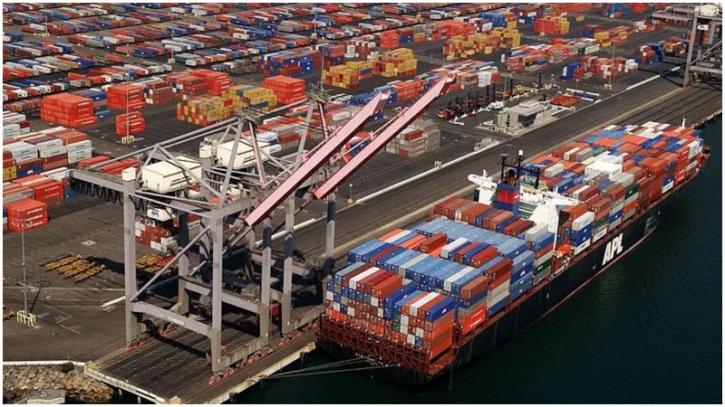

The IMF attributes part of the boost to a surge in U.S. imports earlier this year, as companies rushed to bring in goods ahead of planned tariff hikes. This "front-loading" effect gave a short-term lift to economic activity, but the IMF warns the momentum may not last. Risks such as excess inventory, higher storage costs, and potential product obsolescence could slow trade and weigh on future growth.

Despite the upgrade, the revised forecast still falls short of the 3.3% growth predicted in January, before U.S. President Donald Trump took office, and remains below the pre-pandemic average of 3.7%.

For the U.K., the IMF maintained its forecast, projecting growth of 1.2% in 2025 and 1.4% in 2026. These figures position the U.K. as the third fastest-growing advanced economy over the next two years, behind only the U.S. and Canada.

IMF Chief Economist Pierre-Olivier Gourinchas noted that a fragile easing in trade tensions has helped the global economy remain resilient. Still, he cautioned that current tariff levels continue to hurt global growth and that the temporary boost from early imports is expected to diminish later this year and into 2026.

Meanwhile, global inflation is projected to decline, with price rises slowing to 4.2% in 2025 and 3.6% in 2026. However, inflation in the U.S. is likely to remain above target, as higher import duties push up consumer prices.

President Trump's trade policies — including a universal 10% tariff on nearly all imports and threats of further increases — have disrupted global trade dynamics. Though some of the harshest tariffs between the U.S. and China are on hold until August 12, the IMF warns that upcoming duties on key sectors such as automobiles, steel, pharmaceuticals, and semiconductors were not factored into the current outlook.

Pending trade deals with the EU and Japan were also excluded from the forecast due to ongoing uncertainties. Gourinchas emphasized that the long-term impact of global trade policy will depend on how these agreements and tariffs evolve in the coming months.

.png)