Stocks mixed amid China-US trade talks, tech earnings in focus

Asian markets were mixed on Wednesday as investors monitored developments in China-US trade negotiations and anticipated major tech earnings reports, while also eyeing the upcoming Federal Reserve policy decision.

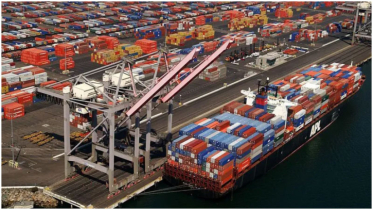

Talks between Washington and Beijing wrapped up in Stockholm after two days without a concrete resolution. However, officials signaled optimism about the possibility of a second 90-day extension to the existing trade truce. While no details were disclosed, US Trade Representative Jamieson Greer emphasized that President Donald Trump would make the final decision on any extension.

US Treasury Secretary Scott Bessent described the tone of the discussions as "very constructive." Market strategist Chris Weston of Pepperstone noted that while a deal remains the base case scenario, investors are aware that Trump’s decision is pivotal, especially with the August 12 deadline approaching.

“The markets appear calm for now, with the expectation of another 90-day extension already factored in,” Weston said. Still, uncertainty lingers, as several countries — including Brazil and India — have yet to secure agreements. Brazil could face tariffs as high as 50%, while India, which Trump called a "good friend," may see 20-25% tariffs. He criticized India’s high trade barriers, saying, “You just can't do that.”

Market performance was varied in early Asian trading: Tokyo was flat; Hong Kong, Singapore, and Manila declined; while Shanghai, Sydney, Seoul, Wellington, Taipei, and Jakarta saw gains.

Investors are also bracing for earnings from US tech giants. Meta and Microsoft report Wednesday, with Amazon and Apple following on Thursday. “The US earnings season has been strong so far,” Weston said. “But for these mega-cap companies, expectations are high — they’ll need to impress, especially given the rising bar and concerns around tariffs and AI spending.”

Meanwhile, the Federal Reserve is expected to hold interest rates steady in its Wednesday meeting. However, market watchers are keen for signals of a potential rate cut in September, particularly after recent data suggested a cooling US labor market.

In commodities, oil prices remained elevated after surging over three percent on Tuesday — their biggest gain in six weeks. The rally followed renewed threats by President Trump to impose additional sanctions on Russia if it fails to reach a peace agreement with Ukraine.

Key figures at around 0230 GMT

Tokyo - Nikkei 225: FLAT at 40,682.14 (break)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 25,409.75

Shanghai - Composite: UP 0.4 percent at 3,624.08

Euro/dollar: UP at $1.1567 from $1.1554 on Tuesday

Pound/dollar: UP at $1.3363 from $1.3357

Dollar/yen: DOWN at 148.06 yen from 148.50 yen

Euro/pound: UP at 86.55 pence from 86.47 pence

West Texas Intermediate: UP 0.1 percent at $69.25 per barrel

Brent North Sea Crude: UP 0.2 percent at $72.68 per barrel

New York - Dow: DOWN 0.5 percent at 44,632.99 (close)

London - FTSE 100: UP 0.6 percent at 9,136.32 (close)

.png)