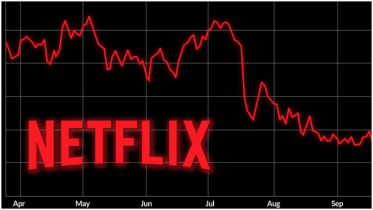

Trump sons' crypto-backed mining firm loses nearly 40% of value amid market turmoil

American Bitcoin, a US cryptocurrency mining company backed by Donald Trump Jr. and Eric Trump, saw its share price plunge almost 39% on Tuesday as early investors rushed to sell after a lock-up period expired. The drop erased around $1 billion from the company’s market value, with trading volume surging to nearly 40 times the usual daily average, according to Bloomberg data.

Eric Trump said the sell-off was driven by investors from a $215 million private placement in June choosing to cash out profits for the first time. He noted on X that such moments would create volatility but stressed he was retaining all his shares and remained committed to the company.

American Bitcoin went public in September through a reverse merger with Nasdaq-listed Gryphon Digital Mining. The company aims to build what it describes as the strongest and most efficient bitcoin accumulation platform. Eric Trump serves as co-founder and chief strategy officer, while Donald Trump Jr. was an early investor.

Company president Matt Prusak said the end of the lock-up period affected trading dynamics but not the firm’s operational assets or day-to-day work.

The sell-off comes as the wider cryptocurrency market suffers a sharp downturn, with investors pulling back from riskier assets. Bitcoin has fallen about 30% since its early-October peak, though it recovered slightly on Tuesday, trading near $91,000.

American Bitcoin, which both mines bitcoin and maintains a strategic reserve, previously operated as American Data Centers before rebranding through a joint venture with mining firm Hut 8. As part of that deal, Hut 8 transferred all its mining equipment to the company in exchange for a majority stake. Hut 8 shares dropped 13.5% on Tuesday.

The Trump family has deepening ties to the crypto sector. The president’s sons also back World Liberty Financial, which has issued billions of its own tokens; its WLF cryptocurrency has lost 86% of its value over the past year, according to CoinMarketCap. Trump Media & Technology Group — the former president’s social media company — has also outlined plans to raise up to $2.5 billion to build a bitcoin treasury, though its own shares are down nearly 70% this year.

Other firms using bitcoin-treasury strategies have also been hit. Michael Saylor’s Strategy, which holds a large bitcoin reserve of about 650,000 tokens, has fallen 40% this year as investor interest wanes amid heavy fundraising and a broader crypto sell-off.

.png)