Gold drops as US-China trade deal optimism weakens safe-haven appeal

Gold prices fell sharply on Monday as optimism over a potential US-China trade deal reduced demand for safe-haven assets and boosted investor appetite for equities ahead of key central bank meetings this week.

Spot gold dropped 1.3 percent to $4,059.22 per ounce by 0837 GMT, retreating further from its record high of $4,381.21 reached on October 20. US gold futures for December delivery slipped 1.6 percent to $4,072.40. The metal has now fallen more than 5 percent from last week’s peak, which had been driven by expectations of US rate cuts and geopolitical concerns.

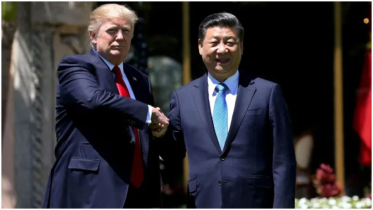

Asian stock markets rallied as signs of progress in trade talks between Washington and Beijing lifted risk sentiment. The US and China reached a framework agreement over the weekend that Presidents Donald Trump and Xi Jinping are expected to finalise during their meeting later this week in South Korea.

UBS analyst Giovanni Staunovo said the prospect of a trade deal is supporting riskier assets and weighing on gold prices. He added, however, that reduced trade tensions could also pave the way for the Federal Reserve to lower interest rates further.

The Fed is widely expected to cut rates by a quarter percentage point on Wednesday following softer-than-expected inflation data in September. With the move already priced in, investors are focused on signals from Fed Chair Jerome Powell about the central bank’s outlook.

“Lower real interest rates should still support gold demand,” Staunovo said. “But with a 25-basis-point cut largely expected, the market may not react strongly to the Fed decision.”

Among other precious metals, spot silver fell 1.3 percent to $47.96 per ounce, platinum slipped 0.3 percent to $1,601.75, while palladium inched up 0.1 percent to $1,429.61.

.png)