Oil prices jump as Trump sanctions Russia's top energy firms

Oil prices climbed sharply in early Asian trading Thursday after President Trump announced sweeping sanctions on Russia’s two largest oil producers, Lukoil and Rosneft, marking the first Ukraine-related sanctions of his second term.

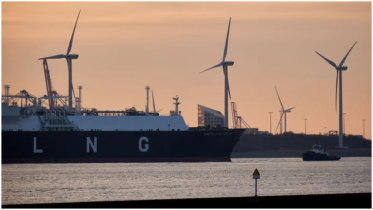

The measures, unveiled late Wednesday in Washington, reflect growing frustration in the White House over Moscow’s ongoing war in Ukraine. They came shortly after the European Union approved its 19th sanctions package, which includes a ban on Russian liquefied natural gas imports, and following a similar move by the United Kingdom last week targeting the same energy giants.

Following the announcement, Brent crude futures rose more than $2 to trade around $64 a barrel, while West Texas Intermediate (WTI) advanced to $59.84. “Given President Putin’s refusal to end this senseless war, Treasury is sanctioning Russia’s two largest oil companies that fund the Kremlin’s war machine,” said U.S. Treasury Secretary Scott Bessent. He urged allies to follow Washington’s lead and adopt similar restrictions.

The sanctions block the U.S. assets of Lukoil and Rosneft and dozens of their subsidiaries, while prohibiting American entities from conducting business with them.

The move represents a major policy shift for Trump, who previously resisted targeting Russian oil firms, preferring tariffs and trade measures instead. Earlier this year, he imposed 25 percent tariffs on Indian goods in response to India’s continued purchases of discounted Russian crude. So far, the administration has stopped short of sanctioning Chinese buyers, another key market for Moscow’s oil exports.

Since Western nations imposed a $60-per-barrel price cap on Russian oil in 2022, Russia has redirected much of its crude sales from Europe to Asia, with India and China emerging as its main customers.

Earlier in the week, oil prices had been under pressure amid worries about oversupply and weakening global demand, especially following renewed trade tensions between Washington and Beijing. Brent crude hit a five-month low on Tuesday before rebounding after the sanctions were announced.

Analysts said the U.S. move could have wide-ranging effects on global energy markets if implemented vigorously. Edward Fishman, a former State Department official, told Reuters that lasting impact would depend on continued enforcement. Meanwhile, Jeremy Paner, a former Treasury sanctions investigator, noted that the absence of restrictions on banks or non-Russian buyers like India and China meant the sanctions “will not get Putin’s attention.”

Trump said he canceled a planned summit with Putin in Hungary, calling it “not the right time,” but expressed hope that the sanctions would be short-lived. “I like to remove sanctions quickly,” he told reporters, adding that such measures risk undermining the U.S. dollar’s global dominance as Russia pushes for alternative payment systems.

Analysts expect oil prices to remain supported in the short term as traders assess potential Russian retaliation. However, prices could ease in the longer run if the sanctions fail to meaningfully restrict exports or if global demand remains weak. For now, volatility appears to be the only constant in the oil market.

.png)