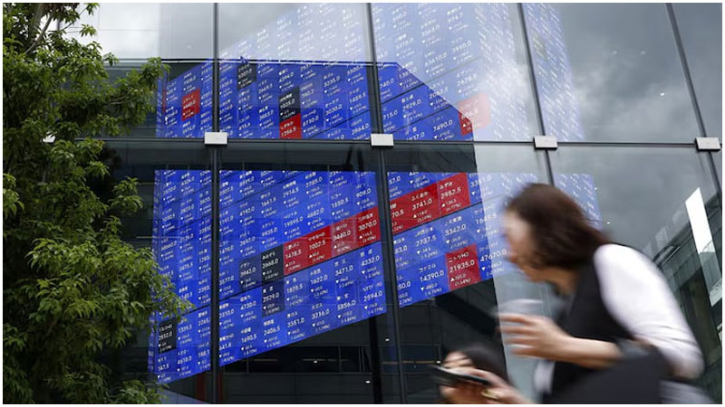

Asian stocks climb despite Trump's semiconductor tariff threat

Asian stock markets rallied on Thursday, shrugging off U.S. presidential candidate Donald Trump’s threat to impose a 100% tariff on semiconductors. Investor optimism remained strong, driven by expectations that the Federal Reserve will cut interest rates next month.

Trump, speaking a day before a wave of new tariffs took effect on multiple countries, announced plans for a 100% tariff on chips and semiconductors, but did not specify when it would be implemented. However, he noted that companies manufacturing in the U.S., such as Apple, would be exempt from the new levy.

Taiwan Semiconductor Manufacturing Company (TSMC) led the gains, soaring nearly 5%, after Taiwanese officials confirmed the firm would be exempt from the tariffs due to its significant U.S. operations. TSMC is expanding its facilities in Arizona and has pledged to invest up to $165 billion in the U.S., calling it the largest foreign direct investment in American history.

South Korea's Samsung, which is also investing heavily in the U.S., rose over 2%, while chipmaker SK hynix gained more than 1%.

Apple-related firms also advanced after the U.S. tech giant announced it would invest another $100 billion in the United States, bringing its total planned U.S. investment to $600 billion over four years.

In Japan, however, the reaction was mixed. Tokyo Electron, a key supplier of chipmaking equipment, dropped more than 2%, while semiconductor maker Renesas fell 3.8%. Precision tools maker Disco Corporation slid 1.8%.

On the upside, Sony jumped 4.1% after it raised its annual profit forecast, citing robust performance in its gaming division and limited impact from new U.S. tariffs.

Analysts believe Trump’s aggressive tariff announcement may be a negotiation tactic. Phelix Lee of Morningstar said the move fits Trump’s pattern of starting with steep demands before backing down, potentially resulting in more moderate tariffs to control consumer inflation.

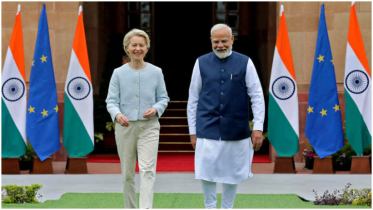

Trump's semiconductor announcement followed his broader “reciprocal” tariff package, which took effect Thursday. These included a doubling of tariffs on Indian goods to 50% due to its continued imports of Russian oil, and 50% tariffs on Brazilian imports implemented Wednesday.

Regional markets were broadly higher, buoyed by Wall Street’s strong performance the day before. Apple and Amazon gained more than 5% and 4%, respectively, lifting investor sentiment.

Major Asian indices in Tokyo, Hong Kong, Singapore, Seoul, Bangkok, Jakarta, and Wellington all closed in positive territory. Taipei led the surge, driven by TSMC’s strong gains.

Shanghai ended higher after official data showed better-than-expected export growth, with increased shipments to the EU and Southeast Asia offsetting weaker U.S. demand. Rising imports also pointed to a pickup in domestic economic activity.

Not all markets joined the rally. Mumbai, Sydney, and Manila ended in the red, as did London and Frankfurt. Paris posted modest gains.

Investors continue to bet on a U.S. rate cut after weak jobs data for May, June, and July pointed to a slowing economy. U.S. futures edged higher in response.

Oil prices also climbed following Trump’s warning of penalties for countries buying Russian oil, reinforcing his hardline trade stance. He specifically targeted India after raising its tariffs.

Traders are also watching for developments in the Ukraine conflict, following Trump’s suggestion he could meet with Russian President Vladimir Putin "very soon" after what he described as "productive" talks between U.S. envoys and Moscow.

.png)