The Bangladeshi politician and his £200 million UK property empire

On a private residential street in northwest London sits a property which was last sold in 2022 for £11 million ($13.8 million). The row of white townhouses is located in one of the UK capital's most affluent neighborhoods, a stone’s throw away from Regent’s Park and Lord's Cricket Ground. Marketing photographs of one of the properties in the development showcase floor-to-ceiling windows, a spiral staircase across several floors, a cinema and a gym.

Now valued at more than £13 million by one property platform, the house is owned by a politician from Bangladesh, a country with currency controls that restrict its citizens, residents and public servants from moving more than $12,000 a year outside the country. The measures also prohibit corporations from transferring funds abroad unless permitted and only when certain conditions are met.

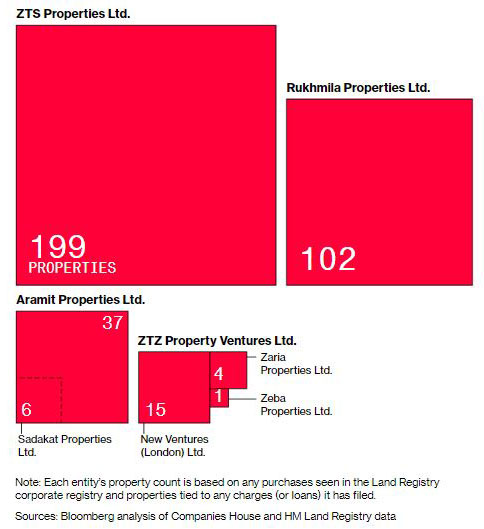

Saifuzzaman Chowdhury served as land minister for five years up to January 2024. Since 2016, companies that he owns have built up a UK real estate empire of more than 350 properties worth about £200 million. These figures are based on a Bloomberg analysis of available Companies House corporate accounts in the UK, mortgage charges and HM Land Registry transactions.

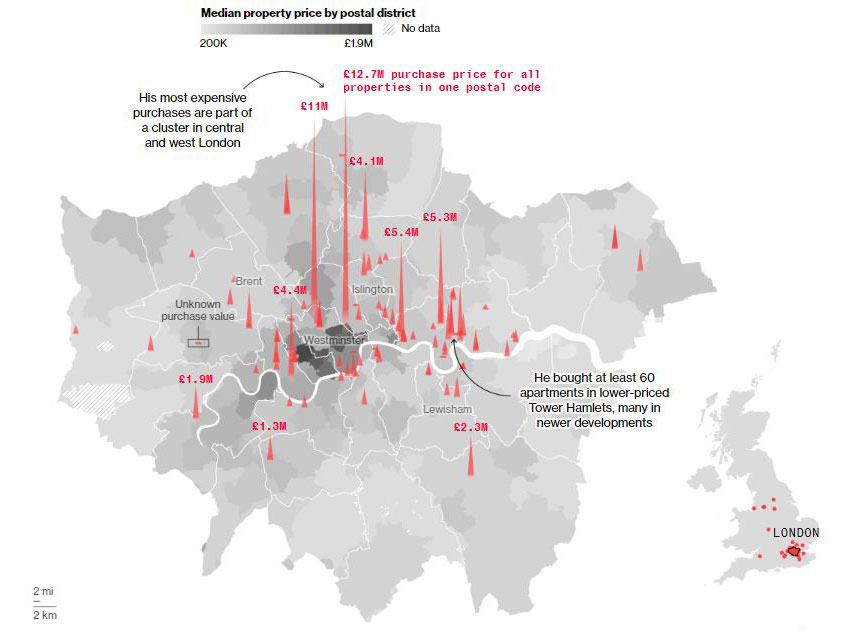

The properties range from luxury apartments in central London to housing in Tower Hamlets, home to the largest Bangladeshi community in England, and student accommodation in Liverpool. Analysis of nearly 250 of the UK properties show that almost 90% were classified as new-builds when bought, a valuable component in a UK housing market suffering severe shortages.

The Daily Star newspaper in Bangladesh reported on a subset of these UK properties in December.

These transactions took place during a period when the UK government had committed to making foreign property ownership more transparent amid criticism of the ease with which Russian oligarchs were able to hide their wealth in the UK. This process became more urgent in the wake of Moscow’s 2022 invasion of Ukraine.

The Chowdhury property deals could revive questions over whether UK legislation to scrutinize such purchases involving politicians are effective, according to transparency advocates.

Bangladeshi Politician Buys London Property Empire

Properties acquired by companies owned by MP and former Land Minister Saifuzzaman Chowdhury, sized by the price paid, where known

Bloomberg has also identified at least five properties in Manhattan belonging to Chowdhury, bought for a total of about $6 million between 2018 and 2020, according to municipal property records.

Chowdhury was re-elected as an MP, but lost his cabinet post after national elections on Jan. 7, which were boycotted by the opposition after anti-government protests were violently put down. He has since become chair of the parliamentary committee for land.

In a pre-election declaration of his interests in December, Chowdhury listed his total assets at about 258.3 million Bangladeshi taka ($2.4 million), and those of his wife, Rukhmila Zaman, at about $993,000. He did not include his UK property holdings in the declaration of assets in Bangladesh. His 2022-23 salary as a minister of state is listed as about £10,000.

The country’s currency controls are policed by the central bank.

“While residing in Bangladesh, there is no provision for an individual to accumulate wealth abroad,” says Mezbaul Haque, a Bangladesh Bank spokesperson, without commenting specifically on Chowdhury. “As a general rule, we do not permit individuals to do so.”

Neither Chowdhury nor Zaman responded to requests for comment on their property holdings outside Bangladesh or the MP’s asset declaration.

Chowdhury falls into the category of a “politically exposed person,” as defined in the UK’s 2017 anti-money laundering legislation. It puts the onus on estate agents, lenders, property lawyers and others involved in business transactions in the UK to have procedures in place to identify PEPs. Although these individuals can engage in business transactions such as buying property, their involvement should attract extra scrutiny.

Bloomberg approached the companies named in this story, including financial services and legal firms involved in the property purchases for the Chowdhury-owned companies. Those firms which responded said the relevant procedures had been followed, but said they could not provide a comment due to concerns over commercial confidentiality.

Transparency International, the campaign group, has identified £6.7 billion worth of “questionable funds” invested in property around the UK since 2016, based on its analysis of individuals and assets linked to high-corruption-risk jurisdictions and corruption cases.

Political Dynasty

Chowdhury entered politics in 2013 succeeding his late father, Akhtaruzzaman Chowdhury Babu, a close ally of Prime Minister Sheikh Hasina. A year later he stepped down from prominent positions at Aramit Plc, a construction company, and United Commercial Bank Plc after being appointed state minister for land.

“I came empty-handed,” he was quoted as saying by the Dhaka Tribune newspaper in 2014, “and I will go empty-handed.”

By 2019 he had been promoted to land minister, a key role in Hasina’s government in one of the world’s most densely populated countries.

Chowdhury and some of his relatives either directly or via subsidiaries hold a majority or a controlling stake in the private shares of over a dozen companies according to a Bloomberg analysis of corporate documents in Bangladesh. This portfolio includes four public companies, among them Aramit and UCB, with a combined market capitalization of about $200 million.

Zaman, Chowdhury’s wife, is chairman of UCB which manages over $6 billion in assets, and is the managing director of Aramit.

In his asset declaration, Chowdhury is obliged to include reference to companies in which he and his wife hold stakes, but not those solely owned by family members.

Aramit and UCB did not respond to requests for comment for this story.

Know Your Client

Bangladesh, ranked 149 out of 180 countries and territories on Transparency International’s Corruption Perceptions Index, implemented strict capital control measures shortly after independence in 1971 to preserve its foreign exchange reserves. But, more recently, those reserves have been severely drained by the impact of the Covid-19 pandemic, inflation and what research by the International Crisis Group has described as economic mismanagement.

The Chowdhury real estate assets in the UK alone are equivalent to at least 1% of Bangladesh’s total foreign currency reserves.

“When politicians from high corruption risk jurisdictions go on a spending spree that far exceeds their official sources of wealth, this should be a major red flag for UK professionals involved in these transactions,” says Ben Cowdock, a lead for investigations at Transparency International UK.

“Looking at this case, you have to wonder whether any of the estate agents, lawyers or financial firms involved have rung the alarm,” adds Cowdock, “and if so, has anyone answered?”

For political figures like Chowdhury, background checks should be standard, but it can be difficult to identify buyers, say some property professionals.

“If they are politically exposed, we have to be aware of that and it can mean that we obviously have to raise a flag on that,” says Nathan Emerson, chief executive officer of professional industry body Propertymark. But the status of buyers isn’t always immediately clear. “If somebody walked into an office today, how would you know that they were a government minister from X country?” he asks.

Who Regulates?

Chowdhury and Zaman are listed publicly as the only directors and owners for all eight companies that account for the real estate purchases.

The Chowdhury Corporate Structure

These eight companies and subsidiaries were used to amass more than 350 properties in the UK

Once property professionals know they’re dealing with a politician or someone related to them, they must, among other checks, “take adequate measures to” establish the source of an individual’s wealth before proceeding with a purchase, according to the legislation. If for any reason they have doubts over the source of the money, they must consider whether to submit a Suspicious Activity Report to the National Crime Agency, which then decides on next steps in each case. The NCA received more than 900,000 SARs during the 2021-2022 financial year, according to its latest figures.

Although such reports are filed to the NCA, if alerted, supervisory bodies such as the government’s tax department, HMRC, and regulators like the Solicitors Regulation Authority and the Financial Conduct Authority can also hand out penalties for breaching regulations.

In 2022-23, there were 391 penalties issued to estate agents for non-compliance with money-laundering regulations. They paid just over £2 million in total, according to HMRC data — an average of about £5,370. “That is absolute peanuts if you are handling this type of money,” says Susan Hawley, executive director of the charity Spotlight on Corruption.

Both HMRC and the FCA said they could not comment on individual cases.

Paul Philip, SRA chief executive, said in a statement: “We take the issue of potential breaches of money laundering regulations very seriously, and will take action if we find firms are not meeting these obligations.”

Property records and mortgage filings show that the Chowdhury companies often used the same estate agents, lenders and property lawyers to handle purchases.

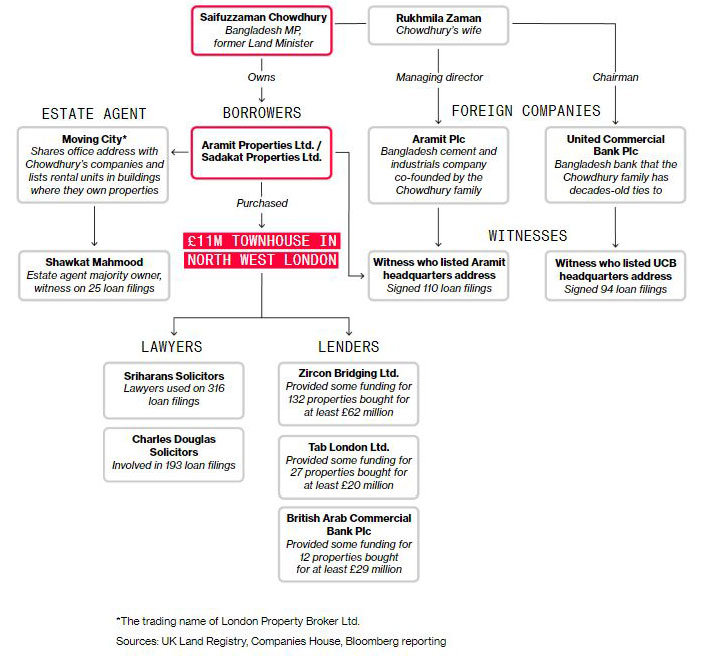

Navigating UK Real Estate

Many of the individuals and firms involved in the purchase of the townhouse in northwest London helped with dozens of other transactions involving Chowdhury-owned companies

Aramit Properties Ltd. — a UK company majority-owned by Chowdhury and distinct from the Bangladesh-based Aramit — has used several UK-based service firms in the management and financing of the £11 million London townhouse first purchased by Chowdhury in March 2021.

The house was resold on February 7, 2022 for £10,950,000 to a company called Sadakat Properties Ltd. — which is owned by Aramit Properties. On the same date, other company filings list a registered charge, or mortgage, from British Arab Commercial Bank Plc for the house, one of 12 property deals struck by the Chowdhury companies for which the bank provided loans.

Paresh Raja is chief executive officer or director of eight financial services firms that lent money in relation to more than 175 of the property deals. The lenders include Zircon Bridging Ltd. and Market Financial Solutions Ltd., according to Bloomberg’s analysis of filings of the companies owned by Chowdhury and Zaman. In all, these eight lenders are tied to at least £88 million worth of real estate deals.

Attempts to contact Raja were unsuccessful, and Market Financial Solutions declined to comment on the story.

Lawyers from two London firms, Charles Douglas Solicitors and Sriharans Solicitors, were involved in almost 80% of the Chowdhury companies’ mortgage filings, in roles ranging from certifying documents to acting as witnesses.

“We can confirm that we carry out all our checks on all of our clients whether politically exposed or not in accordance with our regulatory requirements,” says Subir Desai, a partner at Charles Douglas.

Sriharans did not respond to a request for comment.

At least 25 of the mortgage filings were signed with Shawkat Mahmood acting as a witness for the companies owned by Chowdhury and Zaman. Mahmood is the majority owner of an estate agent which trades as Moving City. It shares the same address — at a WeWork office in the City of London — with all eight of the companies in which Chowdhury has a majority stake identified by Bloomberg.

Almost half of Moving City’s listed rental properties in early January matched building addresses where Chowdhury-owned companies have real estate. It has not been possible to establish whether all the known properties at those addresses — 118 in total — are rented out for the average price of neighboring listings, but if they were, the Chowdhury-owned UK companies would be receiving about £240,000 a month in rent.

“We take our obligations regarding onboarding of clients seriously,” says Ripon Mahmood, Moving City's managing director and CEO, “and all checks that are required to be carried out by our industry and the law are complied with.”

Source: Bloomberg

.png)