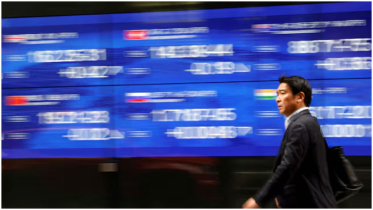

Asian stocks mixed as investors await Fed rate cut decision

Asian stock markets swung between gains and losses on Wednesday as traders paused ahead of an expected US interest rate cut, the first of 2025.

After weeks of strong rallies that pushed several indexes to record highs, investors turned cautious, awaiting the Federal Reserve’s decision later in the day and comments from Chair Jerome Powell. A quarter-point reduction has long been priced in, but the bigger question is how many more cuts could follow and how deep they might be.

Hopes for a prolonged easing cycle have grown on signs of a cooling US labor market, even as inflation remains stuck above the Fed’s 2% target. The feared surge in prices from President Donald Trump’s tariff war has yet to fully appear, but officials face a delicate balancing act between inflation control and supporting growth.

“This is not a comfortable place to be,” said Diane Swonk, chief economist at KPMG, warning of a “mild bout of stagflation” with sluggish growth alongside persistent price pressures.

Fresh US retail sales data showing stronger-than-expected gains in August did little to dent optimism for cuts. Still, traders across Asia largely stayed on the sidelines after a muted Wall Street session.

Tokyo, Hong Kong, Manila, and Jakarta posted modest advances, while Seoul retreated after a string of record highs. Losses were also seen in Shanghai, Sydney, Singapore, Wellington, and Taipei.

“Markets remain in somewhat of a holding pattern ahead of the Federal Reserve’s decision tonight,” said Josh Gilbert, market analyst at eToro. “The biggest risk is that the Fed sounds less dovish than markets are hoping for.”

Gold hovered just below its record high of $3,700 an ounce reached Tuesday, as prospects of lower interest rates bolstered demand for the safe-haven asset.

Meanwhile, fresh trade data revealed the toll of Trump’s tariffs on Japan, with exports to the US plunging nearly 14% in August — the sharpest drop since 2021. Auto shipments collapsed more than 28%, dealing a heavy blow to a key pillar of the world’s fourth-largest economy.

Key figures at around 0230 GMT

Tokyo - Nikkei 225: UP 0.2 percent at 44,995.79 (break)

Hong Kong - Hang Seng Index: UP 0.7 percent at 26,619.45

Shanghai - Composite: DOWN 0.1 percent at 3,858.98

Euro/dollar: DOWN at $1.1857 from $1.1868 on Tuesday

Pound/dollar: DOWN at $1.3643 from $1.3657

Dollar/yen: UP at 146.52 yen from 146.49 yen

Euro/pound: UP at 86.90 pence from 86.87 pence

West Texas Intermediate: DOWN 0.1 percent at $64.46 per barrel\

Brent North Sea Crude: DOWN 0.1 percent at $68.40 per barrel

New York - Dow: DOWN 0.3 percent at 45,757.90 (close)

London - FTSE 100: DOWN 0.9 percent at 9,195.66 (close)

.png)