Stocks steady amid political turmoil as investors focus on rate cut hopes

Global stocks and bonds regained stability on Tuesday despite political turbulence in France, Japan, and the United States, as investor optimism over potential U.S. interest rate cuts continued to underpin market sentiment.

In Europe, the euro fell for a second consecutive day, while equities slipped modestly. Volatility eased somewhat as investors monitored developments in France following the shock resignation of Prime Minister Sebastien Lecornu, which has deepened the country’s political crisis.

Across the Atlantic, the U.S. government shutdown entered its second week, with little sign of a breakthrough in negotiations.

In Japan, investor confidence appeared to recover after a smooth government bond auction, easing jitters triggered by the election of Sanae Takaichi as leader of the ruling party. Takaichi’s preference for loose monetary policy and higher fiscal spending had sparked an earlier selloff in Japanese bonds and the yen, even as stocks hit record highs.

Stocks Hover Near Record Highs

Despite the political noise, global equities remained close to record levels, buoyed by expectations that the U.S. Federal Reserve will begin cutting interest rates and renewed enthusiasm around artificial intelligence, following a multi-billion-dollar chip supply deal between AMD and OpenAI.

“The fundamental narrative is still one of Fed rate cuts, and that’s likely to persist through this year and into next,” said Chris Scicluna, economist at Daiwa Capital. “The AI-driven boost to activity should sustain demand for risk assets, even if politics causes short-term disruptions.”

The U.S. dollar rose 0.3% against a basket of currencies, driven mainly by gains versus the euro and yen. The yen weakened beyond ¥150 per dollar, prompting Finance Minister Katsunobu Kato to warn against excessive volatility.

“The yen is likely to stay under pressure,” said Tareck Horchani of Maybank Securities. “Expectations for more fiscal stimulus and limited chances of a near-term Bank of Japan rate hike are weighing heavily on the currency.”

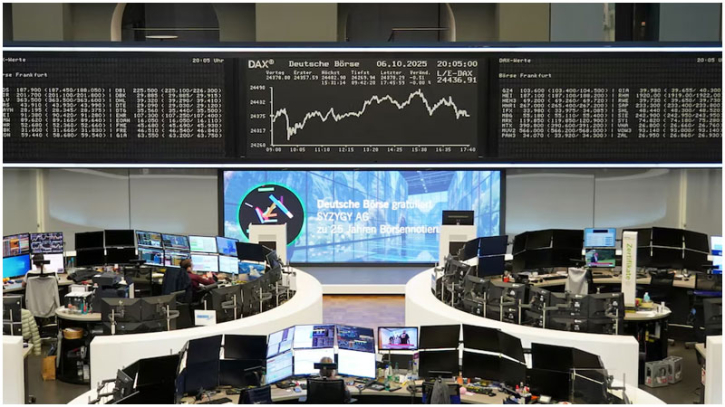

European Markets Edge Lower

Europe’s STOXX 600 index, which hit a record high last week, dipped 0.2%, while France’s CAC 40 fell 0.3%, extending Monday’s sharp losses. French bond yields rose slightly to 3.59%, while the euro weakened 0.3% to $1.168.

President Emmanuel Macron has asked Lecornu to hold last-minute talks with party leaders in a bid to resolve the ongoing political deadlock.

Growth Outlook and Commodities

Elsewhere, U.S. stock futures slipped 0.1%, suggesting a softer open after Wall Street’s record-setting session on Monday. The World Bank raised its 2025 growth forecast for China and much of Asia, though it cautioned that regional momentum could slow next year.

In commodities, oil prices steadied, with Brent crude up 0.17% at $65.58 a barrel. Gold surged to a record $3,977.19 an ounce, while bitcoin traded just below its all-time high of $126,223.

Despite ongoing political uncertainty, markets appear to be maintaining confidence in the broader narrative of easing monetary policy and sustained growth, with investors largely brushing off short-term political risks.

.png)