Stocks struggle as focus shifts to Fed policy, tech valuations

Asian markets were subdued on Thursday as optimism over the end of the record-breaking U.S. government shutdown faded, with investors turning their attention to the Federal Reserve’s next move on interest rates and mounting concerns over a potential tech bubble.

U.S. lawmakers late Wednesday approved legislation to end the 43-day shutdown — the longest in American history — which had halted key government services and delayed the release of vital economic data. President Donald Trump is expected to sign the bill, officially reopening federal operations.

However, the relief rally seen earlier in the week lost steam as traders assessed the economic fallout from the prolonged closure. Analysts noted that even with the government reopening, a quick return to normalcy is unlikely.

“Reopening doesn’t mean an instant snap-back to normal for the real economy,” said Stephen Innes of SPI Asset Management. “When you starve a system of staffing and pay for six weeks, the backlog doesn’t vanish just because a bill passed at 8 pm. The aftershocks show up in queues, call centers, and cash-flow stress far away from the Capitol dome.”

Attention is now turning to the upcoming release of delayed U.S. economic reports, which could influence the Fed’s decision on whether to cut interest rates next month. The White House warned, however, that October job and inflation data might remain unavailable due to disruptions in data collection.

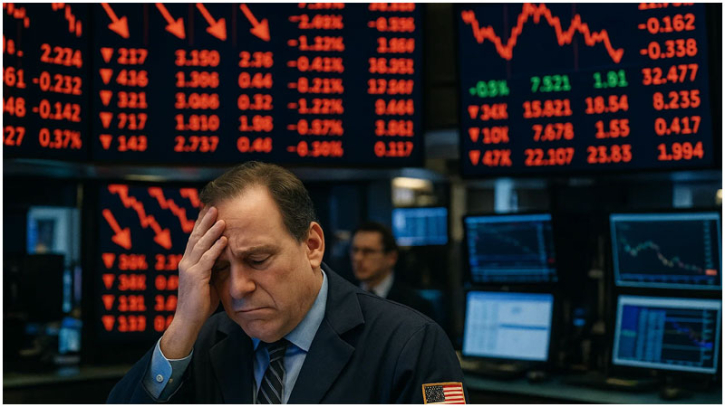

Meanwhile, investor jitters are growing over the sustainability of the AI-driven tech rally that has fueled markets this year. Some analysts fear that sky-high valuations could mark the formation of a bubble, with recent weakness in major tech stocks raising red flags.

The Nasdaq has slipped for two straight sessions, while the S&P 500 has also faltered. In contrast, the Dow Jones Industrial Average hit a record high on Wednesday, with signs that investors may be rotating out of tech and into industrial stocks.

That mixed sentiment carried into Asian trading, where Hong Kong, Sydney, Seoul, Singapore, Taipei, Manila, and Wellington all declined. Tokyo inched higher, while Shanghai and Jakarta were little changed.

Oil prices extended their slide after tumbling around 4% on Wednesday, following an OPEC report forecasting a crude oversupply in the third quarter — a sharp reversal from its previous projection of a deficit. The market has been weighed down by easing geopolitical tensions and rising production among OPEC and other major producers. The International Energy Agency also expects a record surplus in 2026.

In currency markets, Japan drew attention after Finance Minister Satsuki Katayama said the government is closely monitoring the yen’s depreciation. The yen weakened further to around 155 per dollar following her comments, fueling speculation that Tokyo could intervene to stabilize the currency.

The yen’s slide has been driven by the Bank of Japan’s dovish stance, which has dimmed expectations of further rate hikes, even as the U.S. moves past its shutdown and prepares for its next round of monetary policy decisions.

.png)