China's industrial profits rebound amid pressure to curb price wars

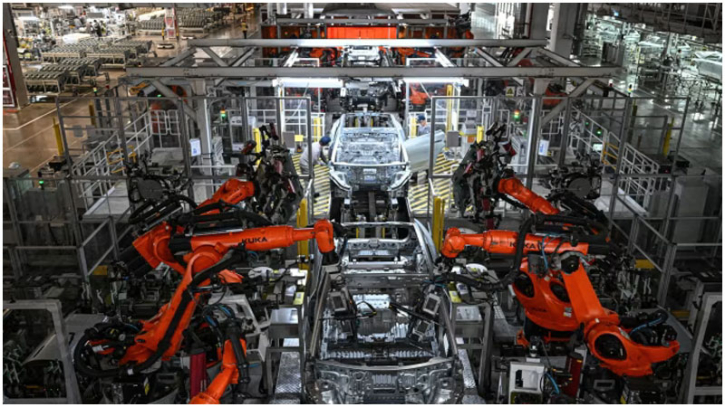

China’s industrial sector posted profit growth in August, marking a rebound after months of weakness, as Beijing pressed businesses to rein in cut-throat price competition caused by overcapacity.

Profits at industrial firms with annual revenues above Rmb20mn ($2.8mn) rose 20.4% year-on-year in August, reversing a 1.5% decline in July, according to the National Bureau of Statistics (NBS). For the January–August period, profits were up 0.9% compared with a year earlier, after falling 1.7% in the first seven months of 2024.

The improvement comes against a backdrop of prolonged economic headwinds, including a sluggish property market, weak consumer demand, and escalating trade barriers, particularly from the United States. Fitch Ratings estimated the effective tariff rate on Chinese exports to the U.S. reached 34% in August, while new measures targeting goods routed through third countries could further strain manufacturers’ margins.

The NBS said the August uptick was supported by falling industry costs, policy efforts to build a “unified national market,” and a low comparison base from last year. “The profits of industrial enterprises have improved significantly,” said Yu Weining, chief statistician at the NBS, though he cautioned that conditions remain “severe and complex” with domestic demand still “insufficient.”

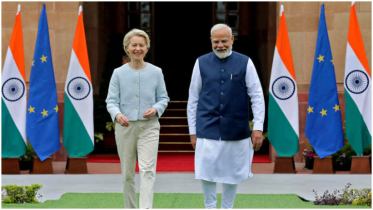

President Xi Jinping has repeatedly urged companies to avoid “disorderly price competition,” which has intensified in sectors such as electric vehicles, where manufacturers are locked in steep price wars. Writing in Qiushi, the Communist Party’s leading theoretical journal, Xi stressed that stabilizing competition was critical to building a stronger national market.

Despite August’s rebound—the first monthly profit growth since April—analysts warn that pressures from weak consumption and external trade frictions continue to weigh on the outlook.

.png)