Bangladesh Bank aims to lift reserves to $40bn to support taka

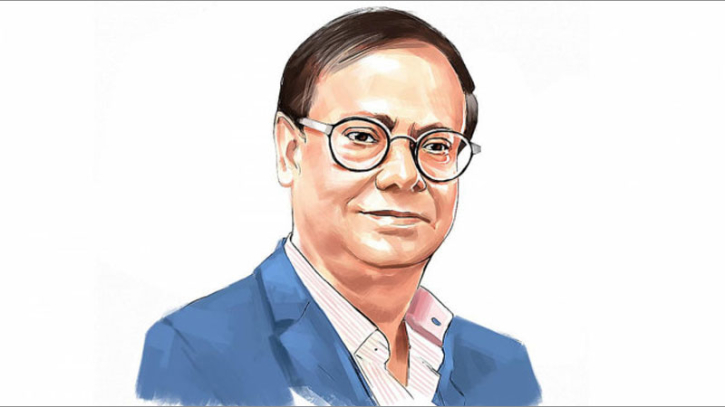

Bangladesh Bank plans to raise foreign exchange reserves to about $40 billion by June to strengthen confidence in the taka, Governor Ahsan H. Mansur said in an interview.

“The market is essentially in equilibrium, and we are now building reserves from a position of strength,” Mansur told Reuters on Saturday, adding the central bank has already purchased over $1 billion in recent weeks without destabilizing the currency. “Our objective is to stabilize the exchange rate, not to fix the price.”

Gross reserves stood at $31.4 billion on Sept. 3 — equivalent to five months of imports by the central bank’s measure, or four months under the IMF’s calculation. Mansur said his goal is to reach six months’ coverage regardless of whether the IMF program continues.

Mansur, a former IMF economist who became governor in August 2024 following the fall of ex-Prime Minister Sheikh Hasina, said the February 2026 election should provide clarity for reforms, including bank consolidation and tighter oversight of non-bank lenders. “If we can sustain these changes for five to 10 years, the financial system will be much stronger,” he said.

The reserve buildup follows nearly $4 billion in cleared arrears to suppliers and power firms — including India’s Adani Group — over the past year. Mansur credited stronger remittances, reduced import over-invoicing, and tighter controls on informal money transfers for the recovery. Exports rose about 9% in the same period, narrowing the current account gap.

The taka has steadied after hitting a record low of 127 per dollar last year. Mansur said the central bank intervened to prevent banks from adopting higher unofficial rates, warning the currency could have otherwise slipped to 135 or 145.

Bangladesh has resisted IMF calls for a fully flexible exchange rate. “I believe in flexibility, but not in reckless overshooting,” Mansur said.

.png)