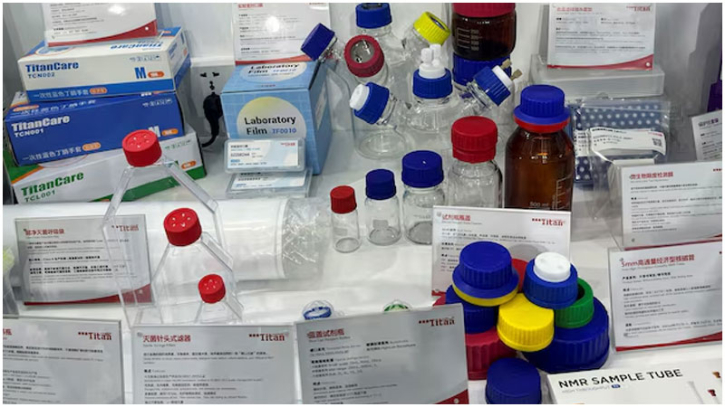

Chinese pharma firms shift to local reagent suppliers to cut costs, speed deliveries

Pharmaceutical research and development companies in China are increasingly turning to domestic suppliers for critical lab reagents, aiming to lower costs and shorten delivery times, industry executives say.

Western suppliers such as U.S.-based Thermo Fisher Scientific and Germany’s Merck have long dominated China’s reagent market — essential for lab testing, analysis, and quality control. But rising import tariffs, supply chain concerns, and cost pressures are pushing Chinese firms toward local producers like Shanghai Titan Scientific and Nanjing Vazyme Biotech.

China’s imports of reagents for lab and diagnostic use were worth $5.76 billion in 2024, down slightly from $5.83 billion in 2023, according to U.N. Comtrade data.

“It’s more advantageous to buy local because timeliness is critical,” said Ma Xingquan, co-president of ChemPartner PharmaTech, noting most of the firm’s pre-clinical reagents already come from Chinese manufacturers. He expects local sourcing to grow as more products become available.

Tariff Shock Accelerates Shift

The move toward domestic suppliers has sped up since April, when China raised tariffs on U.S. goods to 125%. Though duties have since eased amid trade talks, many drugmakers remain wary of policy uncertainty.

Since April, over 90% of Vazyme’s clients have explored replacing imported reagents, according to Senior Vice President Xu Xiaoyu. “Before, they talked about it as a long-term goal. The tariffs made the need immediate,” Xu said.

Titan and Vazyme are both forecast to post strong revenue growth in 2024 — 22% and 15% respectively — while their shares have surged 54% and 18% this year. In contrast, Merck and Thermo Fisher shares have dropped 21% and 8%.

Foreign Firms Localize Production

Analysts expect China’s reagent market to expand by more than 10% annually over the next five years, boosted by government support for biotech and rising demand for R&D and diagnostics.

Merck is building a €70 million reagent plant in Nantong, set to open in 2025, while Roche is expanding its Suzhou production and logistics facilities from 2028 to serve China and Asia-Pacific. Thermo Fisher declined to comment on its China strategy.

Challenges Remain

Switching from imported to local reagents is not always straightforward. Regulatory requirements demand consistent materials, making mid-project substitutions difficult and potentially delaying drug development, said RNA biology expert Huang Linfeng of Duke Kunshan University.

Some domestic manufacturers also face barriers to advanced technology and equipment, which may be patent-protected or hard to obtain. “Production equipment is also not necessarily available for purchase,” noted Cheng Shaojun of Fu Chen Chemical Reagents.

Despite these hurdles, the industry trend is clear: Chinese pharma companies are moving toward homegrown reagent suppliers — and the shift is gathering pace.

.png)