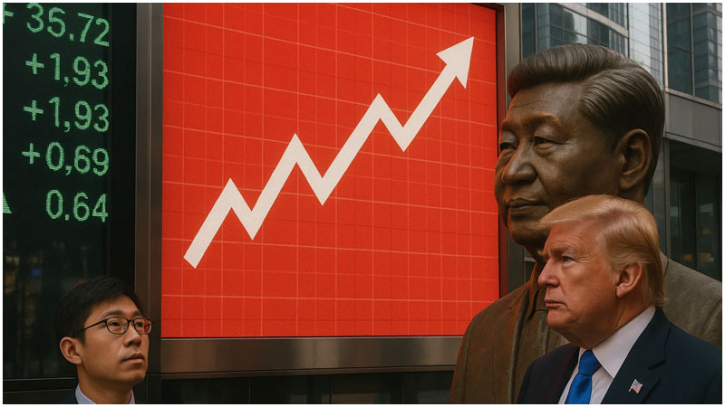

Asian stocks jump as hopes rise for possible Trump-Xi trade talks

Asian stock markets rallied on Tuesday amid growing speculation that U.S. President Donald Trump and Chinese President Xi Jinping may hold talks soon to defuse escalating trade tensions.

The gains come after a rocky start to the week, triggered by Trump’s weekend accusations that China had breached a recent trade truce. He warned of doubling tariffs on steel and aluminum — reigniting investor concerns after a brief period of calm in the ongoing China-U.S. trade war.

However, optimism returned to the markets on hopes that Trump and Xi could engage in direct talks, potentially as early as this week. Trump expressed confidence that a conversation with Xi could ease tensions despite his sharp criticism of Beijing's recent actions.

"They violated a big part of the agreement we made," Trump said Friday. "But I'm sure that I'll speak to President Xi, and hopefully we'll work that out."

While there has been no official confirmation from China, U.S. economic adviser Kevin Hassett hinted Sunday that dialogue might be imminent. Treasury Secretary Scott Bessent also suggested the leaders could speak “very soon.” Additionally, officials from both countries are expected to meet on the sidelines of the OECD ministerial meeting in Paris on Wednesday.

Investors took this as an opportunity to buy back recently sold shares. Hong Kong’s Hang Seng Index rose over 1.2%, and Shanghai’s Composite Index gained 0.2% after returning from a long weekend. Other markets in Tokyo, Sydney, Wellington, Singapore, Taipei, and Manila also posted gains. Seoul remained closed for a presidential election.

The rally followed a strong session on Wall Street, driven by robust earnings from chipmaker Nvidia, which boosted tech stocks.

Still, some analysts remain cautious. “The lift in tariffs is creating another layer of uncertainty and tension,” said Rodrigo Catril of National Australia Bank. He noted that the tariff increases could hurt broader negotiations, with UK and Canadian steel industries likely to retaliate. Ongoing U.S.-China friction over tech, rare earth elements, and student visas further clouds the outlook.

Elsewhere, U.S. Commerce Secretary Howard Lutnick expressed optimism about reaching a trade deal with India “in the not too distant future.” Meanwhile, Japan’s top trade official, Ryosei Akazawa, is reportedly planning another visit to Washington as speculation builds about a possible agreement this month.

Investors are also watching developments in Washington, where debate continues over Trump’s ambitious tax bill. The package could add \$3 trillion to the national debt and includes controversial budget cuts, particularly to healthcare.

Oil prices extended their Monday rally, driven by a weaker dollar and renewed geopolitical concerns. A Ukrainian strike on Russian bombers and ongoing U.S.-Iran tensions added to market jitters. U.S. crude (WTI) rose 1.0% to \$63.16, while Brent crude gained 0.9% to \$65.22. The gains followed news that OPEC+ had agreed to a smaller-than-expected increase in output.

Key Market Figures (as of 0230 GMT)

Tokyo (Nikkei 225): +0.2% at 37,546.85

Hong Kong (Hang Seng): +1.2% at 23,425.37

Shanghai (Composite): +0.2% at 3,352.06

Euro/Dollar: $1.1431 (down from \$1.1443)

Pound/Dollar: $1.3532 (down from \$1.3548)

Dollar/Yen: 143.05 yen (up from 142.71)

Euro/Pound: 84.48 pence (up from 84.46)

WTI Crude: +1.0% to $63.16 per barrel

Brent Crude: +0.9% to $65.22 per barrel

New York Dow: +0.1% at 42,305.48 (close)

London FTSE 100: Flat at 8,774.26 (close)

.png)